Blogs

How about for this title: Streamline Your Commercial Real Estate Transactions in WV

Comprehensive Guide to Commercial Real Estate Transactions in West Virginia

Navigating a commercial real estate transaction isn’t just about finding the right property—it’s about ensuring that every legal, financial, and regulatory detail lines up. Whether you're looking to invest in a retail space, lease office property, or purchase land for industrial development, understanding the process in West Virginia is essential. At Ray, Winton & Kelley, PLLC (RWK), we help buyers, sellers, landlords, and tenants protect their interests through every stage of the deal.

Let’s break down the key components of commercial real estate in the Mountain State.

Types of Commercial Properties in West Virginia

Commercial real estate in WV is more diverse than most realize. Common property types include:

Office buildings: Available in major cities like Charleston, Morgantown, and Huntington. These range from Class A corporate suites to smaller medical or law offices.

Retail properties: Strip centers, freestanding stores, and shopping plazas are spread across urban centers and rural towns alike.

Industrial properties: Manufacturing facilities, warehouses, and logistics centers—especially in areas with access to interstates and rail.

Land listings: From ready-to-develop lots to raw acreage, land investments vary by zoning and intended use.

Each property type comes with its own set of zoning, environmental, and permitting considerations—something RWK regularly advises clients on.

How Commercial Real Estate Transactions Work in WV

Unlike residential deals, commercial transactions are more complex and involve greater due diligence. A typical transaction includes:

Letter of Intent (LOI) or Purchase Agreement

Financing pre-approval or loan structuring

Zoning and regulatory review

Title examination and insurance

Negotiations and closing documentation

Working with an experienced commercial real estate attorney ensures your transaction is structured properly and legally protected.

Buying Commercial Property in West Virginia

Purchasing commercial real estate involves several key steps:

Define your needs and goals. Are you buying for investment, development, or occupancy?

Identify the right property. Work with brokers or search public databases.

Make an offer and negotiate terms. This includes LOIs, due diligence timelines, and contingencies.

Conduct legal due diligence. Title review, zoning analysis, lease audits (if buying leased property).

Secure financing. SBA loans, commercial mortgages, or alternative lending.

Close the transaction. Final walkthrough, funds transfer, and deed recording.

RWK assists with everything from contract drafting to resolving title and zoning issues.

Selling Commercial Property in West Virginia

Sellers must ensure their property is ready for legal scrutiny:

Confirm zoning and use permissions.

Disclose known issues or lease obligations.

Prepare for title searches and inspections.

Negotiate purchase terms with protections against liability.

Having a legal team involved early reduces closing delays and protects your long-term interests.

Leasing Commercial Property in WV

Commercial leases are far more customizable than residential ones. They often include:

Triple net (NNN) or gross lease structures

CAM charges and maintenance obligations

Improvement allowances and build-out clauses

Termination and renewal options

RWK helps both landlords and tenants negotiate leases that are clear, enforceable, and aligned with their business needs.

West Virginia Market Trends

Understanding local and statewide trends can impact timing and investment strategy. Recent trends include:

Low vacancy rates in medical and industrial sectors

Rising lease prices in popular business corridors

Redevelopment projects in former coal communities, spurring retail growth

College-town activity, especially in Morgantown and Huntington, driving demand for office and mixed-use space

Zoning, Permitting, and Regulatory Hurdles

Zoning laws dictate what kind of development is permitted. Changing or challenging zoning designations can involve:

Public hearings

Planning commission approvals

Legal filings for variances or conditional use permits

Our team regularly works with local planning offices across WV to navigate zoning disputes and obtain necessary permissions.

Financing Commercial Real Estate in WV

There are a variety of financing options available:

SBA 504 and 7(a) loans – Ideal for small businesses purchasing commercial property

Commercial mortgages – Fixed or variable rates with various terms

Bridge loans – Short-term funding for properties undergoing renovation or repositioning

Hard money loans – Higher interest loans often used when speed or credit is a concern

RWK can coordinate with your lenders to ensure your financing documents align with the transaction and title requirements.

Legal Due Diligence in WV Transactions

A thorough due diligence process includes:

Title search and insurance

Environmental reports (Phase I/II assessments)

Surveying and boundary verification

Lease audits (if acquiring income-producing property)

Zoning and permit research

RWK assists clients by identifying legal red flags early, giving them the confidence to move forward—or walk away.

Lease Negotiation & Legal Representation

We routinely help clients negotiate fair, protective leases. Key legal terms include:

Use clauses and restrictions

Repair and maintenance obligations

Assignment and subleasing rules

Personal guarantees and default provisions

Whether you’re a tenant expanding your business or a landlord managing multiple properties, our legal expertise minimizes disputes.

Who’s Involved in a Commercial Real Estate Transaction?

A successful transaction typically involves:

Real estate attorneys

Commercial brokers

Title companies

Lenders

Inspectors and appraisers

Planning and zoning authorities

RWK’s in-house legal team provides cohesive support throughout the transaction, coordinating with your other professionals.

Finding Commercial Property in West Virginia

To begin your search:

Use local MLS services or commercial listing platforms (e.g., LoopNet, CREXi)

Contact a local commercial real estate brokerage

Explore city-specific resources (Chambers of Commerce, development authorities)

RWK works closely with regional brokers to help clients evaluate properties from both a business and legal perspective.

Frequently Asked Questions

What’s the average cost of commercial property in WV? Prices vary widely by property type and region. Office space in Charleston may average $100–$150 per sq. ft., while rural land can be under $10,000 per acre.

How long does a commercial transaction take? Anywhere from 45 to 120+ days depending on financing, due diligence, and regulatory hurdles.

What are the most common legal issues? Zoning violations, undisclosed environmental risks, lease disputes, and title defects.

Can I lease with an option to buy? Yes—these arrangements can be negotiated and legally structured with the help of your attorney.

Do I really need a lawyer? Yes. Commercial real estate is governed by complex contracts, regulatory frameworks, and risk factors that a lawyer helps you manage.

Conclusion: Why Legal Guidance Matters

Commercial real estate in West Virginia offers major opportunity—but also carries legal and financial complexity. Whether you’re leasing a new storefront, selling a medical building, or buying land for development, the right legal partner makes all the difference.

At Ray, Winton & Kelley, PLLC, our real estate team provides practical guidance backed by decades of local experience. From contract to closing, we help protect your investment at every step.

Ready to get started? Contact RWK today for a consultation or legal review of your commercial real estate transaction.

If you're in need of legal help, let's talk.

Our lawyers have many years of experience, and are excited to help you with your case. Whatever your legal needs may be, we can provide the experienced legal representation you require. Let's talk about your case and see how we can help you achieve the best possible outcome. Even in circumstances in which we are unable to represent a person, we can often help find another attorney that can. So make us your first contact.

Get In Touch

Phone Number:

Address

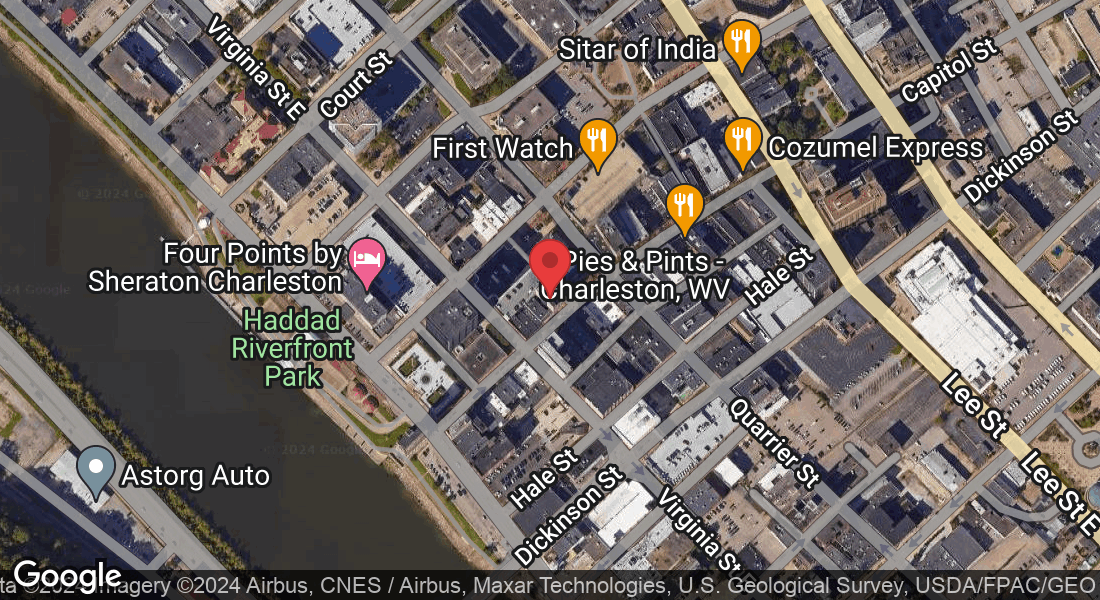

109 Capitol Street Suite 700

Charleston, WV 25301

Assistance Hours

Mon – Fri 9:00am – 5:00pm

Saturday – Sunday CLOSED