Blogs

West Virginia Real Estate Transaction Lawyers: Trusted Legal Support for Property Deals

Real Estate Transaction Lawyers: Your West Virginia Resource

Navigating real estate transactions in West Virginia requires careful attention to legal details that can significantly impact your property rights and financial interests. Whether you're purchasing your first home, selling investment property, or managing commercial real estate transactions, having knowledgeable legal guidance can make the difference between a smooth process and costly complications. At Ray, Winton & Kelly, our experienced real estate attorneys serve as your trusted resource throughout West Virginia, providing the expertise and personalized attention your transaction deserves.

Understand the Role of Real Estate Transaction Lawyers in West Virginia

Learn How Real Estate Lawyers Assist With Property Transactions

Real estate transaction lawyers serve as your legal advocates and advisors throughout the property buying or selling process. Their role extends far beyond simply reviewing documents; they actively protect your interests at every stage of the transaction. In West Virginia's complex real estate landscape, attorneys provide essential services including:

•Comprehensive contract review and negotiation

•Title examination and resolution of title issues

•Due diligence oversight and investigation

•Document preparation and verification

•Representation at closing

•Post-closing follow-up and recording

•Resolution of disputes that arise during transactions

Unlike real estate agents who focus primarily on facilitating the sale, attorneys concentrate on the legal aspects that affect your rights, obligations, and financial interests. This legal perspective helps identify potential problems before they become costly complications and ensures your transaction proceeds with appropriate protections in place.

Explore the Legal Services Offered by West Virginia Real Estate Lawyers

West Virginia real estate attorneys provide a wide range of specialized services tailored to different transaction types and client needs. These services typically include:

Contract Services:

•Drafting and reviewing purchase agreements

•Negotiating contract terms and contingencies

•Creating specialized addenda for unique situations

•Reviewing seller disclosure statements

•Drafting amendments when circumstances change

Title Services:

•Conducting thorough title examinations

•Resolving title defects and encumbrances

•Coordinating with title insurance companies

•Reviewing title commitments and exceptions

•Preparing title opinions when required

Closing Services:

•Reviewing closing documents for accuracy

•Calculating proper prorations and adjustments

•Ensuring proper execution of all documents

•Verifying proper disbursement of funds

•Coordinating with lenders and other parties

Dispute Resolution:

•Addressing inspection and repair disagreements

•Resolving boundary and survey issues

•Handling earnest money disputes

•Negotiating solutions for financing complications

•Representing clients in litigation when necessary

These services can be provided as comprehensive representation throughout the transaction or as targeted assistance for specific aspects of your property deal. Experienced attorneys tailor their approach to your particular needs and the complexity of your transaction.

Identify the Benefits of Hiring a Transaction Attorney

Working with a qualified real estate transaction attorney offers numerous advantages that can save you time, money, and stress throughout the property buying or selling process:

Legal Protection: Attorneys identify and address potential legal issues before they become problems, protecting you from future claims, disputes, or financial losses. This preventive approach often proves far less expensive than resolving problems after closing.

Contract Clarity: Real estate contracts contain complex legal language that can be difficult for non-lawyers to fully understand. Attorneys explain these provisions in clear terms, ensuring you comprehend your rights and obligations before signing binding agreements.

Negotiation Advantage: Experienced attorneys negotiate effectively on your behalf, securing favorable terms and appropriate protections that might otherwise be overlooked. Their knowledge of local market practices and legal requirements strengthens your negotiating position.

Peace of Mind: Professional legal oversight provides confidence that your transaction is being handled properly, with all necessary steps completed correctly and all potential issues addressed appropriately. This reassurance is particularly valuable for significant financial investments like real estate.

Problem Resolution: When unexpected issues arise—as they often do in real estate transactions—attorneys provide efficient, effective solutions based on legal expertise and practical experience. Their problem-solving skills can save transactions that might otherwise fall apart.

Local Knowledge: West Virginia real estate attorneys understand local regulations, market practices, and potential pitfalls specific to different regions within the state. This local knowledge proves invaluable in navigating transactions successfully.

The relatively modest cost of legal representation typically represents a small fraction of the transaction value while providing protection against risks that could result in losses many times greater than the legal fees involved.

Find Qualified Real Estate Transaction Lawyers Near You

Use Online Resources to Search for Local Real Estate Attorneys

Several online resources can help you identify qualified real estate attorneys in your area of West Virginia:

West Virginia State Bar Association: The official state bar website offers an attorney directory that allows you to search by location and practice area. This resource provides basic contact information and confirms that attorneys are licensed and in good standing.

Legal Directories: Websites like Martindale-Hubbell, Avvo, and FindLaw offer searchable directories with additional information about attorneys' experience, client ratings, and professional backgrounds. These platforms often include peer ratings and client reviews that can provide insight into attorneys' reputations.

Local Bar Association Websites: Many county and city bar associations in West Virginia maintain directories of local attorneys organized by practice area. These local resources often provide more detailed information about attorneys practicing in specific communities.

Real Estate Attorney Referral Services: Some organizations offer specialized referral services that match clients with attorneys based on specific needs and location. These services typically pre-screen attorneys to ensure they meet certain experience and qualification standards.

When using these resources, look specifically for attorneys who focus on real estate transactions rather than general practitioners who handle real estate matters occasionally. Specialized experience typically translates to more efficient, effective representation.

Check Reviews and Testimonials of Real Estate Transaction Lawyers

Client reviews and testimonials provide valuable insights into attorneys' service quality, communication style, and effectiveness. When evaluating these resources:

Look for Patterns: Focus on consistent themes across multiple reviews rather than isolated comments. Patterns of praise or criticism typically provide more reliable indicators of an attorney's strengths and weaknesses.

Consider Specific Feedback: The most helpful reviews typically mention specific aspects of the attorney's service, such as responsiveness, attention to detail, problem-solving abilities, or communication skills. These concrete observations often prove more valuable than general ratings.

Evaluate Professional Responses: How attorneys respond to reviews, particularly critical ones, can reveal much about their professionalism and client service approach. Thoughtful, respectful responses typically indicate a client-centered practice.

Check Multiple Platforms: Reviews on the attorney's website may highlight only positive feedback. Check independent platforms like Google Business, Yelp, and legal-specific sites for more balanced perspectives.

Consider Recency: More recent reviews typically provide better indicators of current service quality than older feedback. Legal practices evolve over time, and recent reviews reflect current approaches and standards.

While reviews provide helpful insights, remember that they represent individual experiences that may not reflect how an attorney would handle your specific situation. Use them as one factor in your decision-making process rather than the sole determinant.

Ask for Referrals From Trusted Sources When Selecting a Lawyer

Personal referrals often provide the most reliable path to finding excellent legal representation. Consider seeking recommendations from:

Real Estate Professionals: Real estate agents, brokers, and lenders work regularly with transaction attorneys and can often recommend those who consistently demonstrate professionalism and effectiveness. These professionals understand which attorneys close transactions efficiently while protecting client interests.

Friends and Family: Personal contacts who have recently completed real estate transactions in your area can share firsthand experiences with local attorneys. Their insights into the attorney-client relationship often prove particularly valuable.

Other Attorneys: Lawyers in different practice areas often know which colleagues specialize in real estate transactions and have strong reputations. These professional referrals typically reflect peer assessment of legal skill and ethical standards.

Financial Advisors: Financial professionals who help clients with real estate investments often develop relationships with effective transaction attorneys and can provide informed recommendations.

When requesting referrals, ask specific questions about the attorney's communication style, responsiveness, attention to detail, and problem-solving abilities. Understanding why someone recommends a particular attorney helps determine whether that recommendation aligns with your specific needs and preferences.

Discover Common Real Estate Issues and How Lawyers Resolve Them

Review Typical Disputes That Arise During Real Estate Transactions

Despite careful planning, real estate transactions sometimes encounter complications that require legal intervention. Understanding common disputes helps you appreciate the value of preventive legal guidance:

Inspection and Repair Disputes: Disagreements frequently arise regarding property condition issues discovered during inspections. Buyers and sellers often have different perspectives on what repairs are necessary, who should pay for them, and whether they justify renegotiation of the purchase price.

Financing Complications: When buyers encounter unexpected challenges securing financing, disputes may develop regarding earnest money deposits, contract extensions, or whether financing contingencies were properly exercised. These situations require careful analysis of contract language and timelines.

Disclosure Issues: Sellers have legal obligations to disclose certain property defects, and disputes often arise when buyers discover problems they believe should have been disclosed. These cases typically involve questions about what the seller knew or should have known about the property's condition.

Contract Interpretation Disagreements: Parties sometimes develop different understandings of contract terms, such as what personal property is included in the sale, when contingencies expire, or how certain provisions should be implemented. Clear contract language and professional guidance help prevent these misunderstandings.

Closing Delays: Various factors can delay closings, from document preparation issues to last-minute lender requirements. When these delays occur, disputes may arise regarding who bears responsibility and whether the contract remains enforceable.

Boundary and Survey Issues: Property surveys sometimes reveal discrepancies between legal descriptions and actual usage patterns, leading to boundary disputes or questions about easements and encroachments. These issues may require complex legal analysis and negotiation to resolve.

Experienced real estate attorneys anticipate these potential complications and structure transactions to prevent them when possible. When disputes do arise, they provide efficient resolution strategies that protect client interests while keeping transactions on track.

Understand How Lawyers Handle Title Issues and Disputes

Title issues represent some of the most complex challenges in real estate transactions. These problems affect property ownership rights and can significantly impact transaction viability. Common title issues include:

Undiscovered Liens: Outstanding mortgages, tax liens, judgment liens, or mechanic's liens can cloud title and prevent clean transfer of ownership. Attorneys work with title companies to identify these encumbrances and develop strategies for addressing them before closing.

Boundary Disputes: Surveys sometimes reveal that property boundaries differ from what sellers believed or what previous documentation indicated. These discrepancies can affect property value and usability, requiring legal analysis and potential negotiation.

Easement Problems: Undisclosed easements granting others rights to use portions of the property can significantly impact its value and the buyer's intended use. Attorneys help clients understand the implications of these easements and negotiate appropriate solutions.

Chain of Title Defects: Gaps or errors in the ownership history can raise questions about whether the seller has clear authority to transfer the property. Resolving these issues may require additional documentation, affidavits, or legal proceedings.

Probate Complications: Properties transferred through estate proceedings sometimes have title issues related to improper probate procedures or missing heirs. These situations may require specialized legal work to ensure clear title.

Fraudulent Conveyances: Previous transfers involving forgery, fraud, or misrepresentation can create serious title problems that threaten current ownership rights. These complex issues typically require legal intervention to resolve.

Experienced real estate attorneys address these issues through various strategies, including:

•Working with title insurance companies to obtain coverage exceptions

•Securing releases from lienholders

•Obtaining quitclaim deeds from potential claimants

•Negotiating price adjustments to account for title limitations

•Pursuing quiet title actions when necessary

•Developing creative solutions tailored to specific circumstances

Early identification of title issues allows for more efficient, cost-effective resolution. This proactive approach represents one of the most valuable services real estate attorneys provide.

Learn About Contractual Disputes and Lawyer Intervention Strategies

Contractual disputes in real estate transactions require prompt, effective intervention to prevent minor disagreements from derailing entire deals. Experienced attorneys employ various strategies to resolve these conflicts:

Contract Interpretation: When parties disagree about the meaning of contract provisions, attorneys analyze the language in context, apply relevant legal principles, and work toward mutual understanding. This process often involves reference to standard industry practices and previous court interpretations of similar language.

Amendment Negotiation: Many disputes can be resolved through carefully drafted amendments that clarify ambiguities, address new circumstances, or modify terms to accommodate changed conditions. Attorneys ensure these amendments effectively address the issues while maintaining the integrity of the overall agreement.

Performance Enforcement: When one party fails to fulfill contractual obligations, attorneys may send formal demand letters, document the non-performance, and outline specific remedies available under the contract. This approach often motivates compliance without requiring more aggressive measures.

Escrow Solutions: For disputes involving financial matters, attorneys sometimes negotiate escrow arrangements that allow transactions to close while setting aside funds to resolve the disputed issues later. This approach prevents disagreements about relatively minor amounts from delaying entire transactions.

Alternative Dispute Resolution: Mediation and arbitration often provide faster, less expensive alternatives to litigation for resolving contractual disputes. Attorneys guide clients through these processes, presenting their positions effectively while working toward practical solutions.

Strategic Compromise: Experienced attorneys help clients distinguish between issues worth fighting over and those where compromise makes practical sense. This cost-benefit analysis often leads to reasonable accommodations that allow transactions to proceed successfully.

Litigation Preparation: When other approaches fail, attorneys prepare for potential litigation while continuing to pursue settlement opportunities. This dual-track approach protects client interests while maintaining focus on practical resolution.

The most effective attorneys combine legal expertise with practical problem-solving skills, finding creative solutions that address client concerns while keeping transactions moving forward. This balanced approach typically serves clients better than rigid positions that might technically be correct but practically counterproductive.

Compare Cost Structures of Real Estate Legal Services

Examine the Typical Fees Charged by Real Estate Attorneys

Real estate attorneys in West Virginia typically structure their fees in one of several ways, depending on the transaction type and complexity:

Flat Fees: Many attorneys charge predetermined flat fees for standard residential transactions. These fees typically range from 500to1,500 for basic services, with the exact amount depending on property value, transaction complexity, and the specific services included. Flat fees provide certainty about costs and are common for straightforward transactions.

500

t

o

500 to

Hourly Rates: For more complex transactions or those likely to involve unusual issues, attorneys often charge hourly rates ranging from 150to350 per hour, depending on experience level and location within the state. Hourly billing provides flexibility to address unexpected complications but makes total costs less predictable.

150

t

o

150 to

Tiered Flat Fees: Some attorneys offer tiered fee structures based on property value or transaction complexity. For example, they might charge one flat rate for properties under $250,000 and higher rates for more valuable properties, reflecting the increased responsibility and potential liability.

Hybrid Approaches: Many attorneys combine fee structures, offering flat fees for standard services with hourly billing for additional work beyond the typical scope. This approach provides initial cost certainty while accommodating unexpected complications.

Retainer Arrangements: For ongoing representation or complex commercial transactions, attorneys sometimes work on retainer, with clients providing an initial payment from which fees are drawn as work progresses. This approach ensures attorney availability while spreading costs over time.

When comparing fee structures, consider not just the amount but what services are included, how additional work is billed, and whether the arrangement aligns with your transaction's specific needs and potential complexities.

Assess Additional Costs You May Encounter During the Process

Beyond attorney fees, real estate transactions typically involve various additional costs that should be factored into your budget:

Title Search and Examination Fees: These fees cover the cost of researching property records to verify ownership and identify potential title issues. In West Virginia, these costs typically range from 200to500, depending on property type and location.

200

t

o

200 to

Title Insurance Premiums: Title insurance protects against ownership claims and title defects. Premiums are typically calculated based on property value, with rates in West Virginia averaging 3.50to5.00 per thousand dollars of coverage for standard policies.

3.50

t

o

3.50 to

Recording Fees: County clerk offices charge fees for recording deeds, mortgages, and other documents. These fees vary by county but typically range from 20to50 per document in West Virginia.

20

t

o

20 to

Survey Costs: Property surveys, when required or recommended, typically cost between 300and1,000 for residential properties, with larger or more complex properties commanding higher fees.

300

a

n

d

300 and

Courier and Wire Transfer Fees: Expedited document delivery and electronic fund transfers often incur additional charges, typically ranging from 25to75 per transaction.

25

t

o

25 to

Closing or Settlement Fees: If a separate closing agent handles the settlement, their fees typically range from 300to600 in West Virginia, depending on transaction complexity and property value.

300

t

o

300 to

Document Preparation Fees: Some attorneys charge separately for preparing specialized documents beyond standard forms. These fees typically range from 100to300 per document, depending on complexity.

100

t

o

100 to

A transparent attorney will provide a comprehensive estimate of all anticipated costs at the outset of representation, helping you budget appropriately for the entire transaction. Be sure to ask specifically about which costs are included in quoted fees and which represent additional expenses.

Consider Alternative Payment Options for Legal Services

Various payment arrangements can make legal representation more accessible and manageable for different client situations:

Payment Plans: Many attorneys offer payment plans that allow clients to spread legal costs over time rather than paying the entire amount upfront or at closing. These arrangements typically involve an initial retainer followed by installment payments throughout the representation.

Deferred Payment Until Closing: Some attorneys agree to defer payment until the transaction closes, with fees paid from closing proceeds. This approach can be particularly helpful for sellers who may have limited liquid funds available before the sale completes.

Bundled Services: Some law firms offer package deals that combine multiple services at discounted rates. For example, they might provide reduced fees when handling both the sale of your current home and purchase of a new one, or when representing multiple properties in a portfolio transaction.

Limited Scope Representation: For clients with budget constraints, some attorneys offer unbundled services, allowing you to pay only for specific aspects of representation rather than comprehensive handling of the entire transaction. For example, you might engage an attorney solely for contract review or closing representation rather than full transaction oversight.

Flat Fee With Caps on Additional Charges: Some attorneys who primarily use hourly billing will agree to caps or maximum amounts for certain services, providing some cost certainty while maintaining flexibility for unexpected issues.

When discussing fees with potential attorneys, be forthright about your budget constraints and ask about available payment options. Most reputable attorneys will work with clients to find arrangements that provide necessary legal protection while accommodating financial considerations.

Recognize the Importance of Due Diligence in Real Estate Transactions

Learn Why Due Diligence Is Vital in Property Dealings

Due diligence—the process of thoroughly investigating a property before completing a purchase—represents one of the most critical phases of any real estate transaction. This investigative process serves several essential purposes:

Risk Identification: Due diligence reveals potential problems that could affect property value, usability, or ownership rights. Identifying these issues before closing allows buyers to make informed decisions about whether to proceed, renegotiate, or withdraw from the transaction.

Informed Decision-Making: The information gathered during due diligence helps buyers determine whether a property truly meets their needs and expectations. This knowledge prevents post-purchase surprises that could lead to buyer's remorse or costly remediation.

Negotiation Leverage: Issues discovered during due diligence often provide grounds for price adjustments, repair requests, or other concessions. Without this information, buyers may overpay for properties with significant defects or limitations.

Future Planning: Due diligence findings help buyers anticipate future expenses, maintenance requirements, or development limitations. This foresight allows for more accurate budgeting and realistic expectations about property ownership.

Legal Protection: Thorough due diligence creates documentation of the property's condition and disclosed issues at the time of purchase. This record can prove invaluable if disputes arise later regarding what was known or should have been known before closing.

Financing Security: Lenders typically require certain due diligence elements before approving loans. Completing these investigations helps ensure financing proceeds smoothly without last-minute complications or delays.

The relatively modest cost of comprehensive due diligence typically represents a small fraction of the property's value while providing protection against risks that could result in losses many times greater than the investigation expenses.

Understand How Lawyers Conduct Thorough Due Diligence Checks

Experienced real estate attorneys coordinate and analyze various due diligence investigations to provide comprehensive property assessment. This process typically includes:

Title Examination: Attorneys review property records to verify ownership history, identify encumbrances, and confirm the seller's right to transfer the property. This examination typically covers:

•Deed history and chain of title

•Mortgage and lien records

•Easement documentation

•Restrictive covenants

•Tax records

•Judgment searches

•Pending legal actions

Survey Analysis: Property surveys reveal boundary lines, encroachments, easements, and other physical characteristics that affect ownership rights. Attorneys review survey results to identify potential issues requiring resolution before closing.

Zoning and Land Use Verification: Attorneys confirm current zoning classifications and review applicable regulations to ensure the property can be used as intended. This investigation may include:

•Zoning district verification

•Permitted use analysis

•Setback and dimensional requirements

•Variance or special exception history

•Compliance with current codes

•Pending regulatory changes

Environmental Assessment: For many properties, particularly commercial sites, environmental investigations help identify potential contamination or hazardous conditions. Attorneys coordinate appropriate levels of assessment based on property type and history.

Document Review: Attorneys examine various property-related documents, including:

•Leases affecting the property

•Service contracts that might transfer to new owners

•Homeowners association documents

•Previous inspection reports

•Maintenance records

•Property tax assessments

•Utility information

Physical Inspection Coordination: While attorneys typically don't conduct physical inspections themselves, they help clients understand what inspections are appropriate, review inspection findings, and address legal implications of discovered issues.

Permit and Certificate Verification: Attorneys verify that necessary permits and certificates are in place, including:

•Building permits for improvements

•Certificates of occupancy

•Well and septic permits where applicable

•Compliance certificates for code requirements

This comprehensive approach ensures all significant aspects of the property are thoroughly investigated before purchase commitments become final. The attorney's role involves not just coordinating these investigations but interpreting their legal significance and advising clients accordingly.

Check How to Avoid Common Pitfalls Through Proper Planning

Strategic planning and professional guidance help buyers avoid common due diligence mistakes that could lead to costly problems after closing:

Insufficient Timeline: One of the most common errors is allowing inadequate time for thorough investigations. Experienced attorneys help establish realistic due diligence periods based on property type and potential complexities, ensuring all necessary investigations can be completed properly.

Overlooking Property-Specific Issues: Different properties require different types of investigation. Attorneys help identify which specialized assessments might be necessary based on property characteristics, location, and intended use. For example, rural properties might require well and septic evaluations, while historic structures might need specialized inspections.

Relying Solely on Seller Disclosures: While seller disclosures provide important information, they reflect only what the seller knows or is willing to share. Independent verification of key facts provides essential protection against incomplete or inaccurate disclosures.

Failing to Review Recorded Documents: Many buyers focus exclusively on physical property condition while overlooking recorded documents that might significantly affect property rights or value. Attorneys ensure all relevant records are examined and their implications understood.

Misunderstanding Contingency Provisions: Due diligence contingencies in purchase contracts establish rights to investigate the property and potentially withdraw based on findings. Attorneys ensure these provisions are properly structured and exercised within required timeframes.

Inadequate Documentation: Properly documenting due diligence findings and communications regarding discovered issues provides important protection if disputes arise later. Attorneys help maintain appropriate records throughout the investigation process.

Neglecting Future Considerations: Some issues may not affect current property use but could impact future plans or resale value. Experienced attorneys help clients consider long-term implications of due diligence findings, not just immediate concerns.

Professional guidance throughout the due diligence process helps ensure investigations are comprehensive, findings are properly documented, and appropriate actions are taken based on discovered information. This structured approach provides maximum protection against post-closing surprises and disputes.

Review the Closing Process With Your Real Estate Lawyer

Understand the Steps Involved in the Closing Process

The closing process represents the culmination of a real estate transaction, involving several important steps that transfer ownership from seller to buyer. Understanding this process helps ensure you're properly prepared:

Pre-Closing Preparation: Before the actual closing meeting, several activities must be completed:

•Final document preparation by attorneys and lenders

•Final title search to verify no new issues have arisen

•Calculation of closing costs and required funds

•Arrangement of fund transfers

•Final property inspection by the buyer

•Resolution of any outstanding contract contingencies

Closing Document Review: Your attorney reviews all closing documents before the meeting to ensure accuracy and compliance with the purchase agreement. This review typically covers:

•Deed transferring ownership

•Loan documents if financing is involved

•Closing disclosure detailing all financial aspects

•Title insurance policy

•Various affidavits and certifications

•Proration calculations for taxes and other expenses

The Closing Meeting: The actual closing typically involves:

•Verification of all parties' identities

•Review and explanation of documents

•Signing of all required paperwork

•Collection and disbursement of funds

•Delivery of keys and property access information

•Recording instructions for official documents

Post-Closing Activities: After the meeting concludes, several important steps remain:

•Recording of deed and mortgage at county clerk's office

•Disbursement of remaining funds to appropriate parties

•Issuance of final title insurance policies

•Distribution of closing packages to all parties

•Resolution of any escrow arrangements

Throughout this process, your attorney serves as your advocate and advisor, ensuring all steps are completed properly and your interests are protected. This guidance proves particularly valuable when unexpected issues arise during the closing process that require immediate attention and resolution.

Learn What Documents to Prepare and Review at Closing

Closing involves numerous documents that must be carefully reviewed before signing. Understanding these key documents helps ensure you know exactly what you're agreeing to:

Transfer Documents:

•Deed: Transfers legal ownership from seller to buyer; must contain proper legal description and appropriate warranty provisions

•Bill of Sale: Transfers personal property included in the sale, such as appliances or fixtures

•Assignment Documents: Transfer leases, contracts, or other rights associated with the property

Financial Documents:

•Closing Disclosure: Details all financial aspects of the transaction, including purchase price, loan terms, closing costs, and cash required from buyer

•Loan Documents: For financed transactions, include promissory note, mortgage or deed of trust, and various lender disclosures

•Proration Statement: Shows how ongoing expenses like property taxes and utilities are divided between buyer and seller

Title Documents:

•Title Insurance Commitment: Outlines the coverage that will be provided and any exceptions or limitations

•Title Insurance Policy: Provides protection against ownership claims and title defects

•Property Survey: Shows property boundaries and physical features affecting ownership rights

Certifications and Affidavits:

•Seller's Affidavit: Confirms various facts about the property and seller's ownership

•FIRPTA Affidavit: Addresses foreign investment tax requirements

•Occupancy Affidavit: Confirms buyer's intended use of the property

•Compliance Certificates: Verify adherence to various regulatory requirements

Other Important Documents:

•Transfer Tax Declarations: Required by state and local authorities for tax calculation

•1099-S Form: Reports sale proceeds to the IRS

•Homeowners Association Documents: For properties in planned communities

•Certificate of Satisfaction: Shows previous mortgages have been paid off

Your attorney reviews these documents before closing to ensure accuracy and compliance with the purchase agreement. During closing, they explain key provisions and answer questions before you sign, ensuring you understand all obligations and commitments you're assuming.

Identify How Lawyers Can Facilitate a Smooth Closing Experience

Experienced real estate attorneys employ various strategies to ensure closings proceed smoothly and efficiently:

Proactive Issue Resolution: Attorneys identify and address potential problems well before closing day, preventing last-minute complications that could delay or derail the transaction. This proactive approach includes verifying that all contract contingencies have been satisfied and all required documents are properly prepared.

Coordination With All Parties: Effective attorneys maintain communication with all transaction participants—including lenders, title companies, real estate agents, and opposing counsel—to ensure everyone fulfills their responsibilities in a timely manner. This coordination prevents miscommunications and ensures all necessary components come together properly at closing.

Document Preparation and Review: Attorneys prepare or review all closing documents before the meeting, identifying and correcting any errors or inconsistencies. This advance work prevents delays during the closing itself and ensures all documents accurately reflect the agreed transaction terms.

Clear Explanation of Obligations: During closing, attorneys explain complex legal documents in understandable terms, ensuring clients know exactly what they're signing and what obligations they're assuming. This guidance helps prevent misunderstandings that could lead to future disputes.

Funds Management: Attorneys help ensure all necessary funds are available and properly disbursed at closing. This oversight includes verifying that loan proceeds are received, earnest money is properly credited, and all payments go to appropriate recipients.

Contingency Planning: Experienced attorneys anticipate potential closing complications and develop contingency plans to address them efficiently if they arise. This preparation allows for quick resolution of unexpected issues without derailing the entire transaction.

Post-Closing Follow-Up: After the closing meeting, attorneys ensure all documents are properly recorded, funds are correctly disbursed, and any post-closing obligations are fulfilled. This follow-up confirms that ownership has been legally transferred and all transaction requirements have been satisfied.

Professional legal guidance throughout the closing process provides both practical assistance and valuable peace of mind during what can otherwise be a stressful experience. This support ensures your transaction concludes successfully with all legal requirements properly addressed.

Securing Your Real Estate Future With Expert Legal Guidance

Real estate transactions represent significant financial and legal commitments that deserve professional protection. The guidance provided by experienced real estate transaction lawyers helps ensure your property investment rights are secured, your financial interests are protected, and your transaction proceeds smoothly from contract to closing.

At Ray, Winton & Kelly, our experienced real estate attorneys serve as your trusted resource throughout West Virginia, providing the knowledge, skills, and personalized attention your transaction deserves. We combine deep legal expertise with practical problem-solving abilities to address challenges efficiently and protect your interests effectively.

Whether you're purchasing your first home, selling investment property, or managing complex commercial transactions, professional legal guidance ensures your real estate dealings proceed with appropriate protections in place. Contact us today to discuss how our experienced attorneys can support your specific real estate needs and objectives.

If you're in need of legal help, let's talk.

Our lawyers have many years of experience, and are excited to help you with your case. Whatever your legal needs may be, we can provide the experienced legal representation you require. Let's talk about your case and see how we can help you achieve the best possible outcome. Even in circumstances in which we are unable to represent a person, we can often help find another attorney that can. So make us your first contact.

Get In Touch

Phone Number:

Address

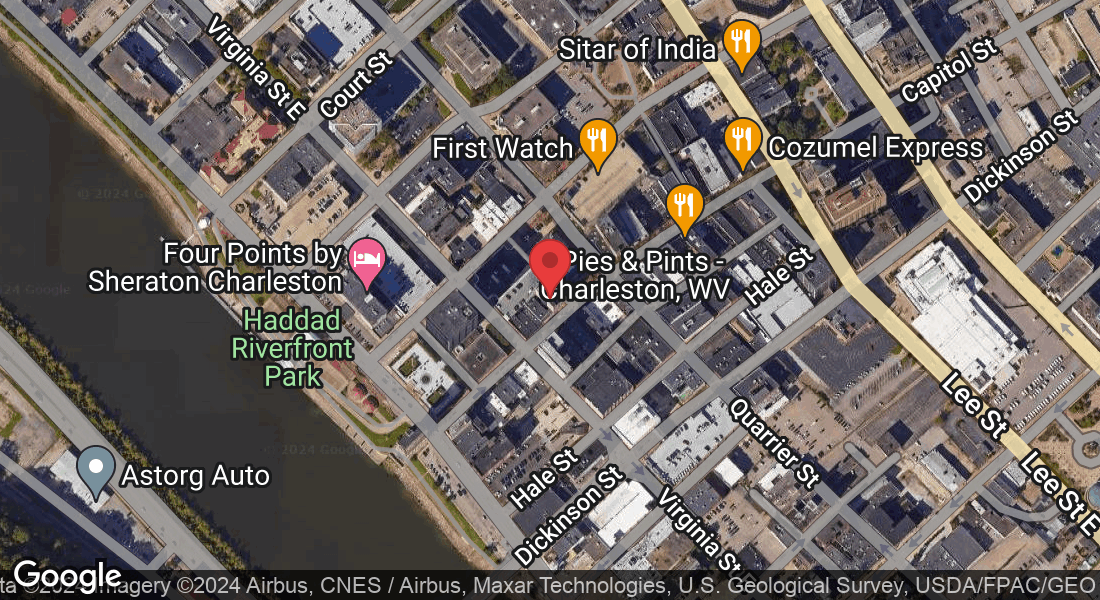

109 Capitol Street Suite 700

Charleston, WV 25301

Assistance Hours

Mon – Fri 9:00am – 5:00pm

Saturday – Sunday CLOSED